About Xero

Xero invoicing is a suite of online accounting software for small businesses, accountants, and bookkeepers. It enables its users to track and manage cash flow processes, invoicing, payments, reporting, and pay runs. Users can use Xero through any one of its three monthly subscription packages: starter, standard, and premium. The software solution is available on Mac and PC platforms.

Xero was founded in 2006, the company is headquartered in Wellington, Wellington, New Zealand.

Xero currently offers a 30-day free trial that includes a 30-day free trial and the ability to:

- Send invoices and quotes

- Enter bills

- Reconcile bank transactions

- Capture bills and receipts with Hubdoc

- Use multiple currencies

- Access on the go with the mobile app

Pricing depends on functionality and volume and can be found here.

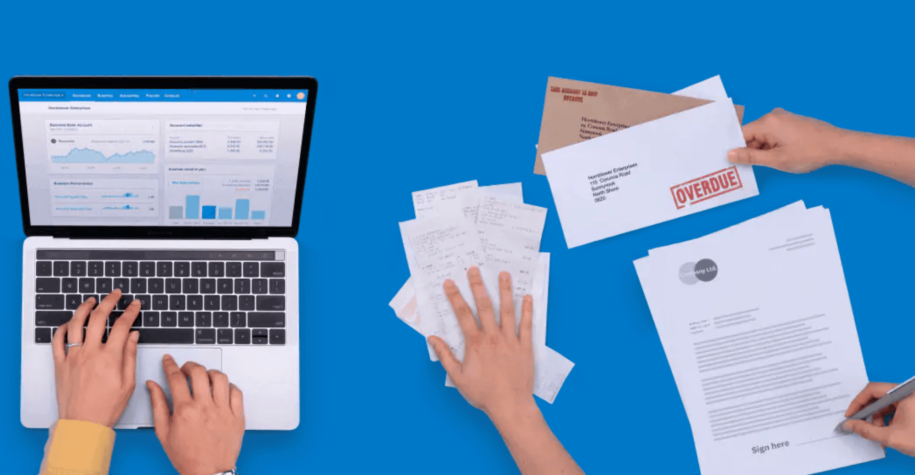

Xero Invoicing Process Overview

- It only took us a minute or so to register for a free trial and to have the ability to start using the full features including invoicing. No credit card was required to get started.

- You’ll have the option to use classic invoicing or new invoicing:

Classic Invoicing

New Invoicing

- You’ll also have the option to “add more details for polished, professional invoices”. These include a logo, phone number, and address, although adding an address should be strongly suggested or required if you plan to collect paper checks via mail.

- Within a minute, you can add or select a recipient, adjust sections of the invoice like line items, due date, and tax rate, preview, and edit an introduction email:

- Shortly after, your invoice will be received by your client with the option to click through and pay. Notifications will be available in the platform and via email.

- You’ll be able to import existing invoices to the system now or in the future.

- Linking your online payment process is simple and includes offering options for credit cards, debit cards, PayPal, and more. For clients that already accept payments through Stripe, integration between systems exists. Seamless connections with your company bank account will allow for fast deposits and access to funds.

- Note that if you’re evaluating Xero with other accounting or invoicing systems, you may not want to send many invoices during the evaluation period. If you’re still undecided after 30 days, you may have outstanding invoices with links to a deactivated Xero account.

- We liked the easy setup and intuitive invoicing interface. Setting up invoice templates would help to accelerate the accounts receivables process. You will also have the option to set repeating or recurring invoices.

- We couldn’t tell any big differences between the two invoice interfaces, so it’s possible that Xero is just phasing to the new, more modern one.

Why you Should Send Invoices Electronically

- The speed and time saving of not having to manually create PDFs, purchase paper materials, print documents, mail, and wait. Even if you’re attaching PDFs to emails, the amount of time you’re wasting per year adds up if you aren’t using invoice automation tools. You also run the risk of email with PDF attachments being blocked by SPAM filters.

- These solutions help greatly reduce or eliminate human error especially when they are part of accounting systems like Xero. No more manual double entry means more accurate billing and better customer relationships.

- You will be able to directly tie in electronic payment options for the convenience of your client and for the benefit of your accounts receivables team. This will accelerate payments and also offer an easier way to incentivize early payments.

- With electronic invoices, you will be creating a digital audit trail to protect yourself against problems collecting past due payments that may end up with a collections agency or law firm.

- This process will reduce wasteful paper and inefficient mail processes that are especially impacted by more work-from-home staff members.

- eInvoices give your team better visibility, especially if you tie in account receivable automation solutions like HappyAR.

About the Market and Alternative Solutions to Check Out

The big Xero competitor is QuickBooks, specifically QuickBooks Online. Any evaluation for small business and small accounting agency software solutions should include the Xero accounting software suite and QuickBooks.

We also think that FreshBooks and Sage Intacct are good SMB options to review. If you are a small business, be careful with more advanced enterprise accounting solutions that may have too much functionality, are difficult to self-implement, and are costly. If you are a larger organization (maybe with over 100 employees) or have a high volume of invoices, looking at mid-size and enterprise solutions would be smart to do.

Agencies should consider solutions that allow for multiple client views and address the needs of the companies they serve.

Invoicing software like Bill.com and Invoiced help to streamline the online invoicing and receivables process without full accounting functionality. These may be good options for companies that have an existing accounting platform but wish to enhance the AP/AR functionality or for those that use an outsourced bookkeeper or accounting firm but elects to send invoices themselves.

You may want to consider an option that has seamless integration with your CRM system in order to capture a complete view of your sales and collection lifecycle and the activity happening with each client.

Note that HappyAR has an open API and connects to all of these major systems to even further improve the collections process.

With all software reviews, we suggest using G2 as an impartial evaluation source.

About HappyAR and our Xero Invoicing integration

HappyAR is a seamless SaaS that quickly and easily boosts your accounts receivables work.

We save companies of all sizes thousands of dollars each year by optimizing the speed and efficiency of their collections methods. No more guessing if someone has received an invoice or trusting that it will be paid on time. This is a fully integrated solution that pays for itself over and over each month by preventing defaults and preserving client relationships.

With all of our accounting and invoice integrations, including Xero, HappyAR pulls all new invoice data over to our system to reduce double entry and to intelligently change steps in real-time for active workflows.

HappyAR is an ever-evolving toolkit that helps optimize your invoice collections process and our solution starts at $0/month and scales up based on your invoice volume. Visit us at www.happyar.com to learn more.