Keeping your company in the black by properly invoicing your customers means providing them with information on their bills that clearly communicates what you expect. Aside from the total amount due, the most important number that your invoices should feature is known as the balance forward.

What Is the Balance Forward?

The balance forward shows the sum of the previous balance (if a client has unpaid invoices or a delinquent previous bill) from a specific date range.

This should be added to a customer’s current balance to show the total amount due. Depending on how long it’s been since the customer last paid, the balance forward may even take into account non-payment from the prior fiscal year.

This number can also be zero if there is no outstanding money due from a previous statement. In other words, it can also show an opening balance.

Bank account ledgers also show balance forwards. For example, if you were looking at a bank account statement for 2021, it might show a detailed list of the current year’s transactions underneath last year’s final balance.

If a negative number appears, this means there was an overpayment on the part of the customer. You can handle this in several ways.

One method is issuing a credit balance to the customer that will go toward their next bill. You may also refund the overpaid amount to their bank account. A negative invoice charge is another way to apply the overpayment to the next bill.

What is a Balance Forward Statement?

A balance forward statement is a single page or document that lists all payment activity that falls in a specific date range.

This statement will show the previous balance at the top to show how the balance forward has been calculated.

Keep in mind, however, that this statement doesn’t necessarily show the current amount that a customer owes because it’s only used to refer to a set time period. For this reason, a balance forward statement is different from accounts receivable, which gives the current balance owed.

Make the Balance Forward Obvious

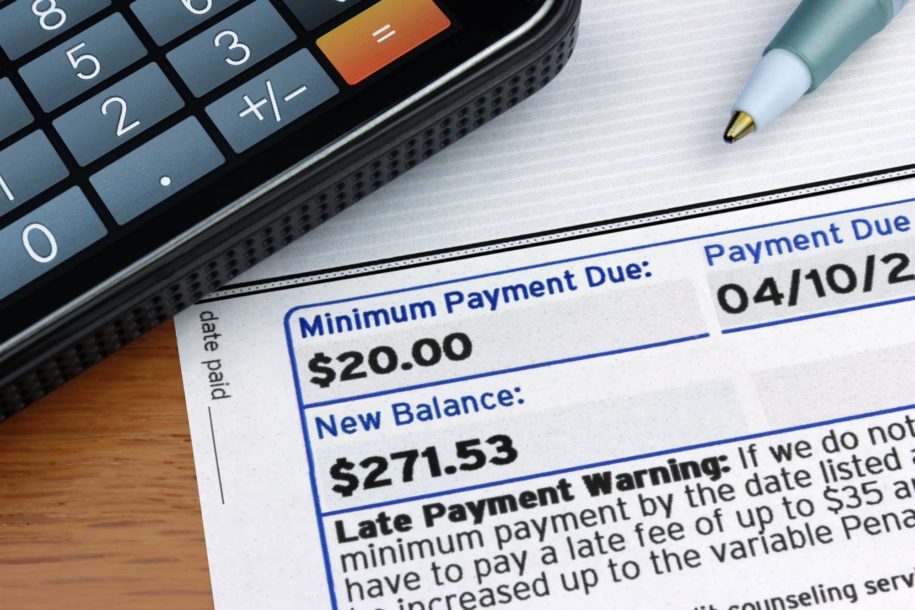

It’s important to give customers visual cues on their bills to show them exactly what you want them to do and where they need to look for information.

The balance due portion of a bill is usually the place you’ll want to guide a customer’s eyes, so you’ll need to make the wording, formats, and design instructional.

For simplicity, many bills feature a box at the top of the page that shows the amount of the last payment, the date of the last payment received, and the balance forward, in that order.

The main body of the bill will show the current date range’s payment due, adding this to the previous balance to arrive at the amount the customer needs to pay. Including a due date and payment terms can help the customer maintain positive standing with their accounts.

How Balance Forward Helps with Planning

The more information a customer has, the better. You want them to pay their bills so your company maintains healthy cash flow, while they don’t want to be delinquent on payments.

Giving your customers a balance forward statement shows them more information than just the total amount due. By understanding the amount they owe for unpaid invoices to make their accounts current, the balance forward helps them see their current standing.

Because credit scores determine buying power in so many areas of life, these statements help customers to avoid interest payments and maintain healthy credit.

When the customer can determine what their proper allocation of funds should be, they are in a better position to stay out of debt and send your company payments in a timely manner.

Accounts Receivable

On your end of the payment chain, you’ll need to keep a balance sheet of accounts receivable for each customer. This will tell you the entirety of what the customer owes. Instead of focusing on a specific date range, accounts receivable will refer to all outstanding debts for a given client.

Accounts Payable

Accounts payable refers to what you owe other companies. When you receive a bill for services rendered by another company, accounts payable is where those payments will need to be logged.

What is an Open Item?

Open items and balance forwards are similar but differ in a fundamental way. While the balance forward amount shows outstanding payments from a specific date range, the open item shows all outstanding payments.

Whether your bills and invoices will show an open item or balance forward amount will depend on how your company makes a customer’s account balance current. If your business provides a grace period for one bill payment before default, then you would probably only ever show a customer their remaining balance forward amount.

Balance Forward in 401(k) and Sharing Plans

For another look at the term “balance forward,” let’s turn our attention to 401(k) accounts. In this context, a balance forward plan is a 401(k) or another type of sharing plan that values accounts on a monthly, bi-monthly, quarterly, or even yearly basis, as opposed to daily.

Generally, balance forward plans are only done with pooled investments.

With valuation happening so infrequently, the account providers can’t show their customers’ the current value of their accounts. Plan assets will likely be different from the last valuation, especially in a turbulent market.

If an account valuation shows $500,000, but it dropped because the market took a downturn, the actual value could be far less. If the customers’ retirement plan terminates after this downturn, they may not realize that they’re not getting the full valuation they expect.

Most plans take market fluctuations into account. If a participant requests payment of the balance, they’ll receive anywhere from 75% to 90% of the current valuation. Once the next valuation is calculated, the participant will receive the remaining balance.

Advance of Technology

Obviously, a balance forward sharing plan is not ideal. Since the advent of computer tracking tools for stocks, bonds, and other investments, plans that show current, accurate valuations have nearly made balance forward plans a thing of the past.

For accuracy’s sake, most people prefer to use plans that offer daily valuations. Most investment plans are moving away from balance forwards for this very reason.

Better Invoicing

Giving a balance forward statement helps all parties to stay on top of their unpaid invoices and other debts. By structuring an invoice with this essential information in a logical place that is easily seen, the customer can track their debts, which makes it more likely that they’ll pay them in a reasonable timeframe.

Having the right structure in place for your statements can also help any employees who are responsible for keeping tabs on the flow of money coming in and out of the organization.

Whether you rely on software to automatically tabulate payments or you use templates for manual entry, remove human error from the equation as much as possible. Find layouts that are easy to read and easy to use, both for your employees and for the clients that receive your statements.

With a firm understanding of the purpose of balance forward statements, you can use them effectively to keep your books up to date and error-free, all while encouraging your clients to pay their debts on time

HappyAR is an ever-evolving toolkit that helps optimize your invoice collections process and our solution starts at $0/month and scales up based on your invoice volume. Visit us at www.happyar.com to learn more.

We save companies of all sizes thousands of dollars each year by optimizing the speed and efficiency of their collections methods. No more guessing if someone has received an invoice or trusting that it will be paid on time. This is a fully integrated solution that pays for itself over and over each month by preventing defaults and preserving client relationships.